The Definitive Guide to Choosing an Employer of Record in the Philippines

— and Why Siegen EOR Is the Benchmark for Global Employers

CFOs, People Leaders and Heads of Operations who need to hire Filipino talent legally, compliantly and at speed face two real options:

A pure software “global EOR platform”. Slick dashboards, yet the burden of Philippine labor law nuances, leave administration and BIR allowance caps remains on your plate.

Siegen EOR. A Philippine licensed Employer of Record that combines award winning HR specialists with a secure ISO 27001 cloud platform. We draft compliant contracts, process payroll and benefits, track every DOLE circular and, critically, can recruit the talent for you. Onboarding in under 48 hours, 100 percent DOLE compliance guaranteed and up to 60 percent payroll savings.

This guide demystifies the legal landscape, quantifies the cost of non‑compliance (₱120 k to ₱250 k per violation¹) and supplies an evidence based checklist so you can compare providers point by point and see why Siegen EOR is widely rated number one in the Philippines.

1. What Is an Employer of Record (EOR)?

The EOR model emerged in the 1990s when US tech firms wanted to hire abroad without setting up subsidiaries. Today, an EOR is a third‑party entity that legally employs talent on your behalf when you lack a local Philippine corporation. The EOR:

Signs a Philippine compliant employment contract

Registers the employee with SSS, PhilHealth, Pag‑IBIG and BIR

Calculates and remits payroll taxes, statutory benefits and 13th‑month pay

Manages terminations, separation pay and government clearances

You retain day to day direction of work; we shoulder the Employer of Record liability.

2. Philippine Compliance Landmines Most Platforms Miss

Every item below is automated in our Siegen EOR-HR platform and cross checked by our Labor Legal Team.

Siegen EOR difference

• All compliance rules are baked into our HR platform so errors are impossible to overlook.

• Every payroll is dual‑audited by a Labor Legal Specialist and a Certified Payroll CPA.

• Clients receive a plain‑language alert and change log within 24 hours of any DOLE, BIR or SSS update.

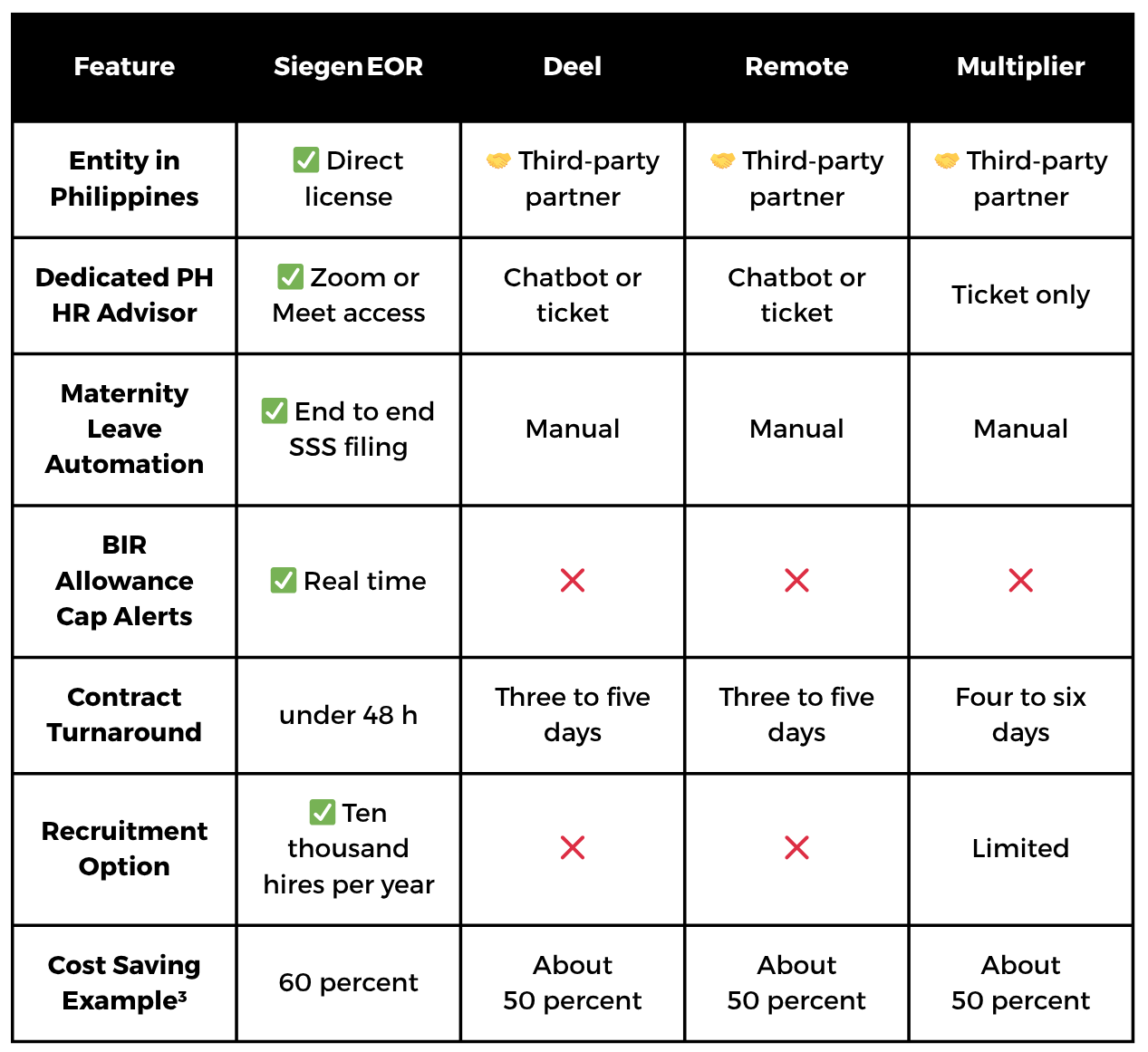

3. Competitor Snapshot – Why “Global” EOR Platforms Fall Short in the Philippines

Table sources: provider documentation accessed May 2025; Siegen client onboarding metrics Q1 2025.

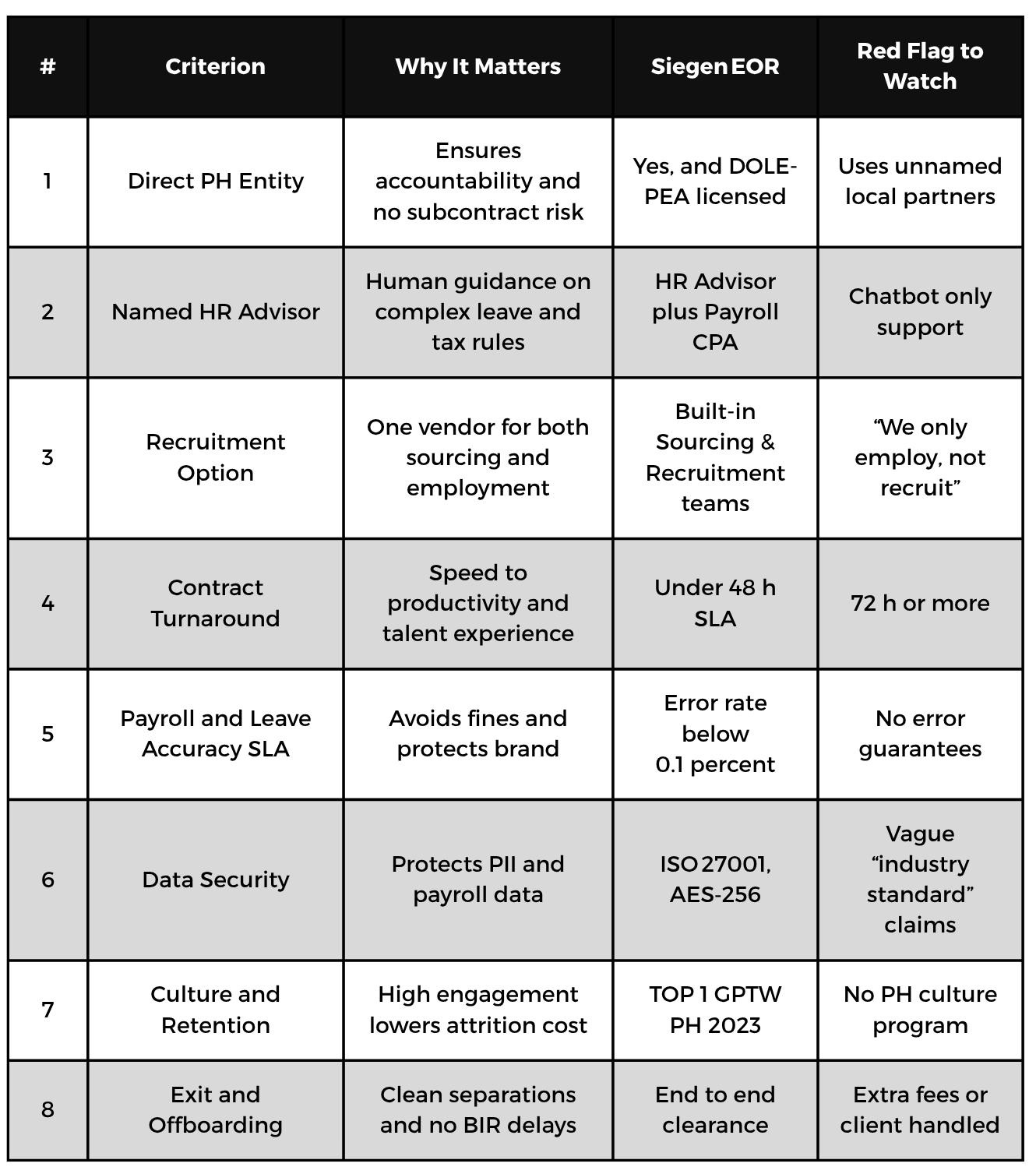

4. The 8-Point EOR Evaluation Checklist

5. How Siegen EOR Delivers Differentiated Value

Human First, Tech Enabled

A European CHRO booked a 30 minute Google Meet to restructure allowances and avoid ₱1.2 million in back taxes, something a ticket system could not solve.

Compliance Locked In

Live monitoring of Wage Board bulletins, RA 11210 amendments and BIR Revenue Regulations. Updates applied before the next payroll cut off.

Recruitment Included or Optional

High demand roles filled in 2024: Senior FP&A Analysts, Data Engineers, US Tax Accountants, Amazon Brand Managers, HubSpot Automation Developers.

Up to 60% Cost Advantage

Example: Three remote Financial Analysts at ₱85 k each per month.

In house SG entity: ₱5.1 million per year salary plus ₱1.4 million admin equals ₱6.5 million.

Siegen EOR: ₱2.4 million salary plus ₱0.6 million fee equals ₱3 million → 54 percent saved.

Culture Employees Brag About

Ranked Number one Best Workplace PH 2023 and Number 17 Asia, translating to a 97 percent retention rate versus industry average 85 percent².

6. Independent Proof and Recognition

Great Place to Work Philippines: Top one, 2023

IBPAP and PMAP Memberships: Active compliance and HR leadership committees

Licensed PH Recruitment Agency (DOLE‑POEA): Licensed since 2016

Client Portfolio: US FinTech scale ups, EU SaaS unicorns, AU e-commerce leaders

¹ DOLE and NLRC penalty ranges, 2024; ² Philippine Statistics Authority attrition survey, 2023; ³ Internal benchmark versus top three global EOR platforms, Q4 2024.